Evaluate Offers from hard money lenders in Atlanta Georgia

Evaluate Offers from hard money lenders in Atlanta Georgia

Blog Article

Why a Hard Money Finance May Be the Right Choice for Your Next Financial Investment

Enter difficult money fundings, a tool that focuses on swift approval and financing, as well as the building's worth over a borrower's credit rating background. In spite of their potential high prices, these loans could be the key to unlocking your following financially rewarding offer.

Recognizing the Basics of Hard Cash Financings

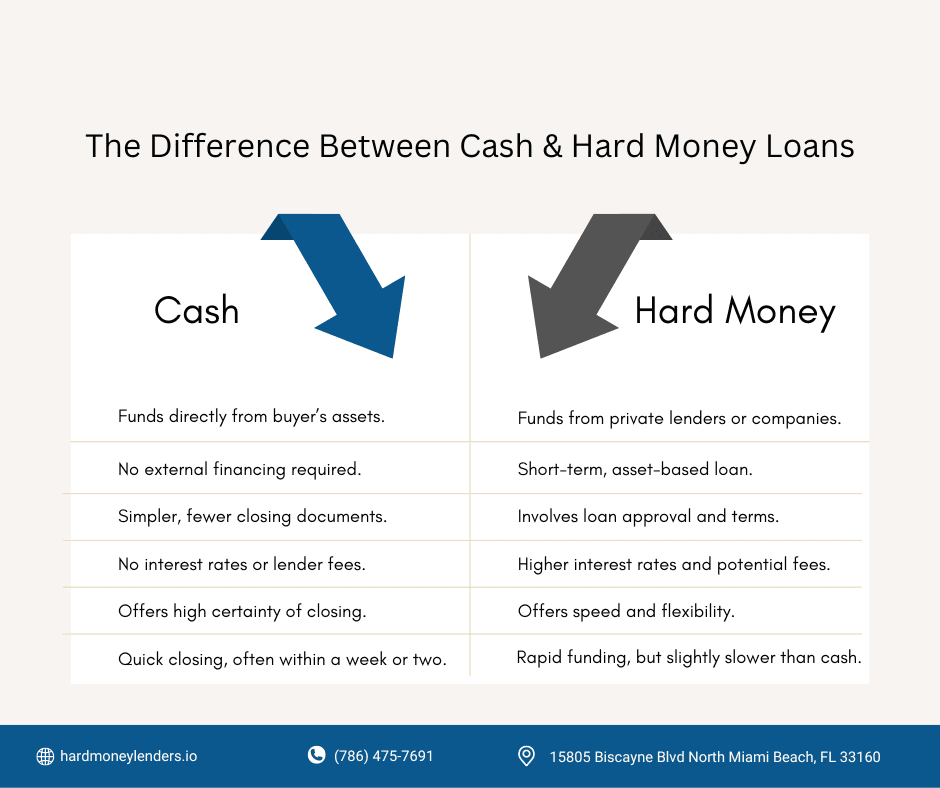

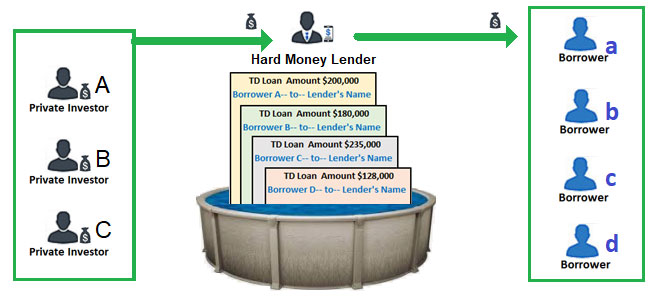

While conventional financings may be familiar to most, understanding the essentials of tough money lendings is critical for potential financiers. Hard money car loans are a type of temporary financing where the investor safeguards the Funding with actual estate residential or commercial property as security. Lenders are typically private business or individuals, making the Lending terms and rates even more versatile than typical financial institution finances.

The Advantages of Picking Difficult Cash Car Loans

Potential Drawbacks of Hard Cash Car Loans

In spite of the benefits, there are additionally possible disadvantages to consider when dealing with tough cash loans. Hard money finances are generally temporary loans, generally around 12 months. These elements can make hard cash finances much less eye-catching for some financiers.

Real-Life Scenarios: When Tough Money Fundings Make Good Sense

Where might hard cash fundings be the perfect economic option? Real estate financiers looking to seize a time-sensitive chance may not have the deluxe to wait for standard bank financings.

Another scenario is when a capitalist intends to restore a home before marketing it. look here Right here, the tough money Lending can fund the improvement, raising the home's worth. When the building is offered, the Financing is after that paid off. Thus, in real-life scenarios where speed and flexibility are vital, hard cash finances can be the suitable solution.

Tips for Browsing Your First Hard Money Loan

Just how does one efficiently browse their very first tough cash Financing? The procedure might appear difficult, yet with careful preparation and understanding, it can become a useful device for financial investment. Research study is critical. Know the specifics of the Finance, including rate of interest, settlement terms, and possible fines. Recognize a reputable lender. Look for openness, expertise, and a strong record. Ensure the financial investment residential or commercial property has prospective revenue enough to produce and cover the Lending income. Last but not least, have an exit strategy. Hard money financings are temporary, generally year. Recognizing how to pay it off-- whether via offering the property or various other refinancing alternatives-- minimizes threat and takes full advantage of gains.

Final thought

To conclude, difficult money finances offer explanation a quick, flexible financing choice for genuine estate investors aiming to maximize time-sensitive chances. In spite of potential downsides like greater rate of interest, their convenience of access and concentrate on residential or commercial property value over creditworthiness make them an eye-catching selection. With cautious factor to consider and sound investment methods, tough cash car loans can be a powerful tool for maximizing returns on short-term jobs.

While traditional financings might be familiar to most, comprehending the fundamentals of tough money car loans is vital for prospective financiers. Tough money financings are a type of temporary financing where the financier safeguards the Funding with real estate home as security. Lenders are typically personal business or people, making the Lending terms and prices even more versatile than standard financial institution fundings. Unlike typical financial institution financings, hard money lenders are primarily worried with the value of the residential or commercial property and its prospective return on financial investment, making the authorization process less stringent. Tough cash finances are typically short-term Home Page financings, usually around 12 months.

Report this page